Chasing New Markets

My initial attraction toward SEO and the web was largely that it was like a new and parallel world that bypassed many traditional gatekeepers.

I wrote an ebook which originally had inconsistent formatting and it was riddled with spelling and grammar errors. I learned to write by writing poorly and often while reading great writers daily.

Ultimately it did not matter that my efforts were subpar on some fronts as few people read early copies, and I was receptive to feedback on how to improve it and rapidly did.

The above process … growing while few people see your ugly work … is actually one of the advantages of *NOT* taking venture capital. You get to learn at your own pace while risks are low and only really lean into something when you know it is working. You keep making small bets that won’t kill you and then when something works better than you expect you can *REALLY* lean into it.

I ultimately did that with SEO, blogging, and a couple other areas I can’t mention too much as I had partners on some projects.

This blog never even started as its own site. It was a section on a different site that was spun out to become its own site when it was obvious blogs were being algorithmically over-promoted due to the cross linking from other bloggers and the instant exposure RSS feeds offered.

Instead of begging a book publisher to publish a book I had a higher margin product and the book publishers were begging me. The market was inverted and an outcast won by bypassing traditional gatekeepers.

When SEO was easy it was the same sort of deal. As long as you tried to learn about what the algorithms valued & put effort behind it you could rank for almost anything.

Early on that meant begging, buying, or borrowing links any way you could. If a project was throwing off big money you’d try public relations and to get high quality links to help reinforce the position and increase its longevity. But even junky links worked fantastic back in the day. That’s part of why there was so much blog comment spam, referrer spam, expired domains, cheeseball web directories which actually had pagerank in the URL, article directories, private blog networks, all sorts of other paid links like Text-Link-Ads.com, etc. etc. etc.

New channels provide new opportunities. Small players prove the model, drive adoption, and then over time the affiliate or independent publisher is replaced by some big publisher or a scrape-n-displace offering from the central market operators.

The Media Water Cycle

If you take a broad enough view of the world the above sort of water cycle repeatedly happens across all media formats and channels.

- New channels emerge

- Smaller players and hobbyists are attracted to the new and shiny object

- Limited competition & regulation

- Channel grows wildly

- Channel locked down by regulation or a monopoly

When the channels are new they have the greatest chance of failure, but the biggest potential rewards for early adopters.

As channels are established and competition increases almost all the profit margins get handed over to the central market operator. Everything gets adjust on an „as needed“ basis. Anything that hands too much of the profits over to a third party publisher gets cloned by the central network operator, becomes against the terms of service, or is algorithmically or manually neutralized by the central market operators.

- affiliates used to be able to sit at the end of the conversion funnel and extract profits from the most valuable keywords, but new algorithmic signals make it hard to stay competitive with limited value add, differentiation, or brand building

- commercial keywords are all ads in the search results above the fold & many brands feel the need to bid on their pre-existing brand equity for defensive purposes

- Google hid keyword data from organic search & later started to hide some from paid search campaigns as well.

- the Chrome browser by default only allows extensions to be downloaded from their official store & while Google got a lot of Chrome distribution through negative option bundling on Flash security updates, they prohibit app bundling in their app store

- Apple’s iOS and Google Android allow the central network operators to track third party app usage. The Apple Appstore and Google Play have mandatory 30% rakes and may disallow certain widely used apps after those features have been baked into the operating system or cloned and default bundled on new phones.

- YouTube takes a 45% revenue share rake & the ad inventory is sold exclusively through Google tools where Google takes up to another 20% rake off the top

- Amazon uses your sales data and product design to create what amounts to an effective clone job of it (going so far as to say there are fake safety issues to demand to see where it was manufactured) and then you are forced to bid on your own brand as Amazon gives itself free ads on your brand for their product clone job

- Google and Facebook try to suck content into their networks via Instant Articles and AMP. Google gives AMP priority placement in their search results (just like they did previously with Google+, Google Checkout, Google Base / Google Shopping / YouTube / etc etc etc).

- Rather than competing, Google and Facebook partnered to illegally bid rig auctions to destroy header bidding & preserve monopoly profit margins, keeping control over external publishers. Google also pushes „privacy“ obfuscation which harms third party publishers and third party ad networks while bypassing those firewalls for its own ad network. They are also looking to use their web browser to do away with cookies, further kneecapping other ad networks.

- Early Pinterest Ads sent users offsite and often cost only a couple cents a visit while all the internal cross promotion & viral spread across Pinterest was effectively free. Then over time advertisers start getting charged for pins even being opened and getting a user to actually leave Pinterest and click through can cost $5 or $10 a click. Long after I saw Reddit threads about how I was a washed up hack who could not compete in the modern market I literally used Pinterest to seed the growth of a site which now gets about a million organic search visits a month. I recently tried further promoting that site on Pinterest in some new areas, but the economics no longer works for that particular site on that channel.

Oligarchs Don’t Stay in Power by Being Fair

If you play by the rules suggested by private market participants you are betting that they won’t dramatically change their ecosystem at the drop of a hat and they won’t compete against you.

And that bet is a REALLY bad bet.

Networks do not stay on top & in control by stagnating. They change with society & if they are influential enough they also change the structure of society.

The Texas AG lawsuit of Google for manipulating the online display ad market lays bare how power works:

Google employees agreed that, in the future, they should not directly lie to publishers, but instead find ways to convince publishers to act against their interest and remove header bidding on their own.

I could easily write a 100 page blog post on that lawsuit while feeling guilty for leaving many things out.

For example, did you know Google stole AdSense earnings from publishers in the AdTrader ad network and lied about refunding that money to advertisers as AdTrader also managed some of the advertiser accounts which got a $0.00 rebate:

We confirmed through multiple sources, both within and outside of Google, through our Google invoices, and data collected from Google APIs that Google never actually refunded any of the confiscated publisher earnings to the advertisers. In fact, Google’s own support team admitted that they never had a system in place for such refunds.

Google is the network I have studied most and know the most about, though others certainly know Facebook equally well. All the large networks growth the predacious exploits.

Even with limited Facebook usage I know they have at various points in time promoted: games, hype headline fake news, lists and viral quiz junk from Buzzfeed, real actual news sites, the Instant Articles version of real actual news, live video, friend content, etc. Facebook also bought Onavo, a VPN network to track the growth of competing apps. That data was used to inform their WhatsApp purchase. And they could see which features from what external networks they should clone, like when Instagram copied much of SnapChat’s offering.

You can follow the Facebook terms of service in everything you do, but the odds of that delivering you real and sustainable profit streams is low.

„You can be unethical and still be legal that’s the way I live my life“ – Mark Zuckerberg

Optimize and Reinvent

Few publishers will be experts at both optimizing for the flaw or overpromotion in the current algorithm or network set up AND being good at reinventing themselves to appeal to the algorithms of tomorrow. You ultimately want to use some of any excess profits to build a destination people seek out so you are less dependent on the central network operators.

At the same time, if you ignore the algorithms and just hope for the best you are probably going to lose to a competitor who clones most of your strategy AND manipulates the result set.

You sort of have to figure out what is being over-promoted today AND then try to figure out what will matter tomorrow, while reinvesting profits to the point you are no longer really faking it until you make it.

Realizing that all success is temporary is vital to encourage yourself to take advantage of the opportunities in front of you, while also ensuring you have a plan B in place that acts as a bridge to tomorrow in case your primary channel bombs.

Almost all profit margins (particularly for newer players lacking access to connections, massive cashflows, strong legacy brands, etc.) come from operating somewhere in the gray area. Behave in a manner that is legal, but push the boundaries of terms from other players.

Google funded eHow. Demand Media was ultimately a pump and dump operation. Those who followed it late got their asses handed to them, but those who got in early had plenty of profits they could reinvest in other lower risk ventures. At one point Mahalo publicly listed their page-level earnings data. One of my buddies went through and put that keyword list through TextBroker and uploaded a few hundred articles to an old blog. After about a year that led to a free house for one of their family members. 😀

Now Google has far more data to use so it is hard to be anywhere near as exploitative or lowbrow as an eHow or a Mahalo was and expect that stuff to back out.

When Matt Cutts was on TWIG in 2013 he stated:

If you want to stop spam, the most straight forward way to do it is to deny people money because they care about the money and that should be their end goal. But if you really want to stop spam, it is a little bit mean, but what you want to do, is break their spirits. There are parts of Google algorithms specifically designed to frustrate spammers. Some of the things we do is give people a hint their site will drop and then a week or two later, their site actually does drop. So they get a little bit more frustrated. So hopefully, and we’ve seen this happen, people step away from the dark side and say, you know what, that was so much pain and anguish and frustration, let’s just stay on the high road from now on.

…

Some of the stuff I like best is when people say „you know what, this SEO stuff is too unpredictable, I am just going to write some apps.“

This past year is the year when „writing some apps“ was revealed to have the same core problems that SEO has. Central market operators grabbing their tithings (fight between Apple and entities like Spotify and Epic Games, Google Play pushing through similar 30% rake requirements) and then outright banning apps like Parler from their app stores.

COVID-19 Accelerated Shift to the Web

The COVID-19 pandemic moved everyone and everything online.

The ad money follows the attention stream. If the central network operators pay creators nothing then those creators who have a following will find other ways to monetize. Cygnus was early to SEO and he was early to influencer marketing.

Selling a sliver of attention and then using that funds flow to improve website usability, website design, content quality, brand awareness, reach, etc. … is usually going to work out better for most people than trying to raise venture capital. Many small bets and incremental improvements yields much higher odds of success than a few really big bets.

Speaking of bets, I follow the stock market a bit because it teaches a lot about human psychology, markets and marketing.

Well before the COVID-19 crisis happened the repo market froze. In fact, the Federal Reserve was discussing alternative ways to fund the market’s liquidity without looking like they were directly subsidizing and bailing out hedge funds:

the new approach could also create political problems for policy makers, analysts said. The problem centers on the central bank lending directly to hedge funds, the little-regulated investment vehicles that tend to serve wealthy or institutional investors. … Though hedge funds are key participants in the market—where they both borrow and lend cash—lending to them directly through the FICC would raise questions about whether the government was backstopping their bets, analysts said.

When the COVID-19 crisis happened optics no longer mattered. Bailouts ensued. Without them levered hedge funds were screwed as many instruments became illiquid and spreads blew out even in bedrock stable markets:

Of particular concern: The hedge funds were using trading strategies similar to those employed by Long-Term Capital Management, a fund that collapsed in 1998 and nearly caused a financial meltdown. The bet that hedge funds were making earlier this year was simple enough. Called a basis trade, it involved exploiting a price difference in the Treasury market, generally by selling Treasury futures contracts — promises to deliver a bond or note at a set price on a set date — and buying the comparatively cheap underlying securities.

Shiny New Object to Bet On

Toward the end of last year and early this year Bitcoin was a rocket ship on the thesis of mass money printing leading to currency debasement and revaluing finite alternatives to fiat cash upward.

And then regulators began dropping hints while banks started to put the breaks on it. And XRP got kicked hard by the SEC, leading to delisting.

Tether may be an absolute scam (it’s hard to short Patio11’s knowledge), but in spite of that there are a lot of retail traders bored at home chasing anything that moves. There are ETFs like GBTC sucking up a huge share of the Bitcoin float with no intent of ever liquidating any of the position.

If sports and society shut down and people are stuck in their homes gambling is an unsurprising source of entertainment. Barstool Sports founder David Portnoy got this and quickly became a day trader when he didn’t have any sports to talk about. 😀

Above I mentioned a bit how the Federal Reserve was ultimately bailing out hedge funds. In an easy money market where central banks are printing tons of money what a lot of hedge funds do is buy higher beta growth names while shorting lower beta value stocks, particularly if they feel those companies are destined to go under.

In some cases the short bets believe ideas from a category apply to a specific company in a way they do not. And that can lead to a massive short squeeze, especially if the company announces a buyback and/or insiders buy.

In other cases, the shorts are so confident in their position, they go HOG WILD with low interest leverage and literally short the entire float of a company, trying to drive it into bankruptcy.

Recently Melvin Capital and some other well-connected hedge funds went short GameStop’s stock and people who visited a Subreddit named WallStreetBets took the other side of that position.

Here is the original thread from 4 months ago discussing the gamma squeeze.

GME has a 52-week low of $2.57. After being pumped by the Subreddit the stock closed today at $347.51, leading to billions in losses for hedge funds which shorted over 100% of the stock.

According to @S3Partners, short sellers lost $14.3 billion on $GME stock today… just today.— Riley de León (@RileyCNBC) January 27, 2021

The hedge funds that shorted over 100% of a stock … were market manipulators aiming to manipulate a market. They were counterfeiting:

how do you get 130% of the available shares short? It would seem impossible and is unless someone cheats.

There are some players in the market who have „market maker“ status but also trade their own books or have cross-interests with those who do. Allegedly there are „Chinese walls“ between those pieces (or interconnected entities.) Quite obviously that is a load of crap because otherwise what you’ve seen would be impossible but it clearly not only has happened before but is still happening to this day. These entities are how you wind up with short sales where the locate and borrow hasn’t happened first and the position remains open across time. This is supposed to be illegal but other than a few hand-slaps in the futures markets for physical commodities I’m not aware of any criminal prosecution for doing it.

And let’s be clear here: This practice is counterfeiting.

When they win, that is capitalism.

When they lose, they get bailed out, contact regulators and have pressure applied to prevent THE WRONG PEOPLE from winning.

There are over 2.6 million Wall Street Bet users and only 10,000 hedge funds. The power of the proletariat is now!— Reddit Investors (@redditinvestors) January 27, 2021

The SEC published a statement on market volatility, the Biden administration mentioned it was watching GameStop, Nasdaq’s CEO suggested halting trading to allow hedge funds to steamroll Reddit users, the Discord group for WallStreetBets was shut down, and Reddit (at least temporarily) banned the WallStreetBets subreddit for hate speech.

That WallStreetBets was temporarily nuked will likely make the degenerate gamblers even more aggressive.

Emergency Press Conference – The Suits Shut Down @wallstreetbets @WSBChairman My prediction is tomorrow will be intergalactic for $amc $gme $nok

(Im not a financial adviser. Don’t listen to me) pic.twitter.com/oYrsPOz8Vx— Dave Portnoy (@stoolpresidente) January 28, 2021

You can see a lot of moves coming if you understand internet culture.

does one throw one, two, three, four, or five hundy at $TR on open? :)— uoɹɐɐ (@aaronwall) January 26, 2021

But in many ways we are now where the outcomes will be pre-determined in order to ensure THE RIGHT PEOPLE win.

Wall Street Bets does to the suits what the suits have been doing to main street for a century. Then one call to Reddit, one call to Discord, one call to Robinhood…

It there anyone out there who still doesn’t think the system is rigged against the little guys?— Tyler Winklevoss (@tyler) January 28, 2021

Politicians will determine outcomes after the fact.

I’m assuming that the next time a hedge fund starts to make too much money shorting and destroying a business, that they will be de-platformed from their Blomberg terminal and throttled by their prime broker in the name of orderly markets and consumer protection.— Tyler Winklevoss (@tyler) January 28, 2021

The more THE WRONG PEOPLE win, the more intervention there will be to correct the natural order.

The Fed throws in trillions in liquidity & stocks fly higher it’s cool.

Pelosi loads up on $TSLA calls the stock flies higher it’s cool.

Bunch of little retail guys load up on calls & stocks fly higher it requires White House & Treasury monitoring & servers get shut down.Right.— Sven Henrich (@NorthmanTrader) January 28, 2021

Risk is much higher than most perceive because outcomes matter more than process & some multi-generational politically-connected wealth is losing badly to THE WRONG PEOPLE.

Gamestop:

Perhaps they got lucky.

Maybe just a flash in pan.

So dismiss them if u want.

But if read their messages u see its not just about money.

They’re discovering their voice.

& that they’re powerful.

IMO this is partly why wont be so easy for Fed to bailout Eurodollar Mkt…— Santiago Capital (@SantiagoAuFund) January 28, 2021

An upstart online stock broker set trade commission prices to zero. Other brokers followed. And now that broker is telling stock buyers which tickers they are no longer allowed to buy.

Robinhood will not allow opening positions in $GME $AMC $BB $BBBY $NOK $KOSS $NAKD— Open Outcrier (@OpenOutcrier) January 28, 2021

When THE WRONG PEOPLE win we find our two sided markets become one way trades.

It’s hard to find market manipulation more flagrant than this, but since it’s being done to protect the wealthiest and most powerful — Wall St oligarchs who own and control the establishment wings of both parties — it’s very hard to imagine the government treating it as such: https://t.co/VJnXpMAqkJ— Glenn Greenwald (@ggreenwald) January 28, 2021

Can that be called a marketplace or even an attempt at a remotely honest market?

No.

And it is even worse than it looked initially, as Robinhood not only prevented customers from buying $GME stock, but created a cascading wave of selling by placing „theft by conversion“ forced sell orders at market on customer accounts.

They are automatically selling shares. pic.twitter.com/o9XCdL9ND1— Sunny (@555Sunny) January 28, 2021

When Robinhood placed „at market“ sell orders for their clients – WITHOUT THEIR KNOWLEDGE OR PERMISSION – they literally *created* the interim market bottom.

Robinhood literally auto sold people’s positions at the BOTTOM #Robinhood $GME #Stocks pic.twitter.com/JekgDq2FHc— Astral Trades (@AstralTrading) January 29, 2021

That is fraudulent, criminal market manipulation.

When hedge funds ‚collude‘ and discuss top picks at Ira Sohn (and prices move as they speak), that is legal + legit.

When 2.5 million retail investors spot an opportunity to make money and ‚collude‘, that is totally illegal + not legit.

Brokers then collude to screw them!— Puru Saxena (@saxena_puru) January 28, 2021

Only losers actually eat creative destruction:

„just like 2008, trading was shut down to save the hides of erstwhile high priests of “creative destruction.” Also just like 2008, there are calls for the government to investigate the people deemed responsible for unapproved market losses. … it was all well and good for investment banks and executives of phoney-baloney companies to gorge themselves on funhouse profits on a funhouse economy, but when amateurs decided to funnel just a bit of this clown show into their own pockets, finance pros wailed like the grave of Adam Smith had been danced upon.“

We are now at the point that the internet is no longer a spot for weirdo outcasts & instead it is reshaping the rest of society.

The times and methods change, but the players remain the same.

If you’re looking for an analog on how Citadel might be playing this Melvin/$GME/@RobinhoodApp fiasco, remember that back in the early 2000’s Citadel invested in Comscore so they could get exclusive rights to their traffic data DAYS before anyone else. Same game, different name— PAA Research (@ActAccordingly) January 29, 2021

Thanks for your attention and your money:

Both of these stories are narratives for our very own Hunger Games, a spectacle that chews up the participants in the arena while delivering enormous profits to the networks (media, financial and political) that put them on. Media networks count their profits in eyeballs, in the attention the Games garner. Financial networks count their profits the old-fashioned way, in the sheer volume of dollar-generating order flow the Games produce. As for politicians, they get their most valuable coin of the modern realm – an issue. The wackos on the left get to propose insane transaction taxes. The wackos on the right get to tell us how much liBeRtY we are enjoying by giving Ken Griffin all of our money. The very serious centrists get to tell us about how we need “a national conversation” about the T+2 settlement issues raised here.

In Need of False Gods

After people get repeatedly screwed spite and revenge become motivators. Some will not mind napalming themselves so long as the entire ship goes down.

Part of a person as awful as Trump getting elected as president was micro-targeted South Park inspired videos sent to minorities reminding them of Hillary Clinton’s super predators speech.

And who could forget her laughing about having the head of Libya murdered, a former nation which fell apart to such an extreme degree they had open air slave auctions.

Rescuing the Criminals, Dumping the Costs on You

Another part of Trump getting elected was Obama promising „Hope and Change“ but then standing between banks and pitchforks for the intentional and malicious fraud that led to the 2008 economic blowup.

A Citigroup insider had the Obama cabinet picked out before he was even elected.

Citigroup was the biggest TARP recipient.

Citicorp is the same company which illegally merged with Travelers, then had that merger made legal after the fact by getting the Great Depression era Glass-Steagall Act regulation repealed:

“I think we will look back in 10 years‘ time and say we should not have done this but we did because we forgot the lessons of the past, and that that which is true in the 1930’s is true in 2010,“ said Senator Byron L. Dorgan, Democrat of North Dakota. “I wasn’t around during the 1930’s or the debate over Glass-Steagall. But I was here in the early 1980’s when it was decided to allow the expansion of savings and loans. We have now decided in the name of modernization to forget the lessons of the past, of safety and of soundness.“

After the internet stock bubble popped the Federal Reserve lowered rates dramatically and left them there far too long, creating a massive hunt for yield. This led to a housing bubble and deteriorating loan standards with fog-a-mirror NINJA loans and similar dominating the market due to the insatiable demand for „risk free“ yield. Entities like Citigroup created a ton of bogus mortgage paper they knew was garbage. Their entire board of advisors was repeatedly emailed by Richard M. Bowden about the fraud:

I started issuing warnings in June of 2006 and attempted to get management to address these critical risk issues. These warnings continued through 2007 and went to all levels of the Consumer Lending Group. We continued to purchase and sell to investors even larger volumes of mortgages through 2007. And defective mortgages increased during 2007 to over 80% of production.

If you control the government economic outcomes are determined by politics.

Citigroup was so confident in their control of the political outcomes they continued to dump bad loans on the FHA after Fannie Mae and Freddie Mac were forced into receivership.

THE RIGHT PEOPLE WON.

„Squeezing the oligarchs, though, is seldom the strategy of choice among emerging-market governments. Quite the contrary: at the outset of the crisis, the oligarchs are usually among the first to get extra help from the government, such as preferential access to foreign currency, or maybe a nice tax break, or—here’s a classic Kremlin bailout technique—the assumption of private debt obligations by the government. Under duress, generosity toward old friends takes many innovative forms. Meanwhile, needing to squeeze someone, most emerging-market governments look first to ordinary working folk—at least until the riots grow too large. Eventually, as the oligarchs in Putin’s Russia now realize, some within the elite have to lose out before recovery can begin. It’s a game of musical chairs: there just aren’t enough currency reserves to take care of everyone, and the government cannot afford to take over private-sector debt completely.

…

From long years of experience, the IMF staff knows its program will succeed—stabilizing the economy and enabling growth—only if at least some of the powerful oligarchs who did so much to create the underlying problems take a hit.

…

But there’s a deeper and more disturbing similarity: elite business interests—financiers, in the case of the U.S.—played a central role in creating the crisis, making ever-larger gambles, with the implicit backing of the government, until the inevitable collapse. More alarming, they are now using their influence to prevent precisely the sorts of reforms that are needed, and fast, to pull the economy out of its nosedive. The government seems helpless, or unwilling, to act against them.

…

The third Citigroup bailout, in late February, converted government-owned preferred stock to common stock at a price significantly higher than the market price—a subsidy that probably even most Wall Street Journal readers would miss on first reading.“ – Simon Johnson, The Quiet Coup

Any government which intentionally subsidizes and promotes massive fraud undermines its legitimacy.

Citigroup winning while most people lost was *explicit* government policy:

“When you look at who benefits from the Chinese trade surplus and the US trade deficit, it’s the same group of people,” he said. In the US it was the banking elites, while in China it tended to be the political elites, but in both countries ordinary workers lost out

Obama was so rotten he made Trump look like a reasonable choice.

Soulless Corporations Promoting Racism as a PR Diversion

Who were the people hurt worst by Citigroup’s fraud?

So it should come as no surprise Citigroup published „research“ on how racism is holding back the U.S. economy.

Believing you can somehow know an individual simply by the color of their skin or by their ethnic heritage is the epitome of ignorance, has been the source for unimaginable evil throughout history, and it is something that woke progressives and white supremacists have in common.— Leonydus Johnson (@LeonydusJohnson) January 30, 2021

Don’t blame Citigroup for stealing your house, crashing the economy, and causing millions of people to lose their jobs. Instead, blame white people. Perhaps you could hit an old white man walking down the street in the back of the head with a brick and upload your crime videos to your social media channels. #hope #change

Large & corrupt companies which plunder society pretend to care about subgroups as a cheap form of public relations and to keep their brand from being associated with what they actually do.

Crash the economy, spread misinformation, then as people point fingers back and forth for your bad deeds everyone can blame the victims.

„Not only were many of those people who’d been foreclosed upon or laid off or forced to watch their 401Ks lose half their value still in emotional shock, but the underlying corruption was not exactly easy for them to see. Propaganda blasted out on every channel, to the effect that it was your own fault if you took on an adjustable-rate mortgage that went sideways, or bought too big of a house. People above all feel shame when they can’t pay their debts, and many took it to heart when pundits said the crash was caused by people buying houses they couldn’t afford.

Those criticisms often came out as racial politics, as conservative media figures hammered the theme of the “water drinkers” who crashed the economy at the expense of the “water carriers.” Listening to these takes, resentment in some neighborhoods grew toward the family down the street who’d been foreclosed upon, leaving a boarded-up eyesore on the block and collapsing property values for those left. The Tea Party movement, launched by a rant on CNBC against a proposed bailout for minority homeowners in particular, steered public anger away from Wall Street and toward the “bad behavior” of the “losers” down the street.

…

Why they were pissed off gets to the second question, about the bailouts, ZIRP, the TARP, even the CARES Act. While so many people went into personal tailspins from 2008 on, their nightmares were often compounded watching as the very people who caused the crash — including the banks and mortgage originators who knowingly pumped mountains of fraudulent subprime instruments into the economy — not only got saved but were further enriched, by bailouts and an array of extravagant Fed programs.Some people got ripped off three times. First, they were personally sold dodgy exotic mortgages. Next, their retirement funds were sold the same kinds of dicey loans in the form of securities. Lastly, when it all blew up, they paid taxes to bail out the whole shooting match.“ – Matt Taibbi

No bank wants to have the brand Wells Fargo has earned for opening up millions of fake customer accounts to charge fees to, stealing people’s cars after charging them for bogus force placed insurance policies, etc.

Executives at those companies concerned primarily with stock option values know being corrupt and donating to BLM is more profitable than running a business honestly & ethically. Fraud is alpha.

If Obama the president matched Obama the candidate the Citigroup board would have been imprisoned, that bank would have been dismantled, and the above „research“ about racism which diverts attention away from crimes by the likes of Citigroup would not have been published.

Large institutions – particularly those which are bailed out after committing massive fraud – are able to survive market cycles. Most individuals carry debt of some sort (education, healthcare, housing, auto, other financed purchases). When the economy craters if they lose their job they may also lose their homes and be forced to sell whatever other financial assets they have near the market bottom to afford food.

Institutions vs Individuals

The pain of Citigroup’s fraud was felt widely across the economy.

„I was in my early teens during the ’08 crisis. I vividly remember the enormous repercussions that the reckless actions by those on Wall Street had in my personal life, and the lives of those close to me. I was fortunate – my parents were prudent and a little paranoid, and they had some food storage saved up. When that crisis hit our family, we were able to keep our little house, but we lived off of pancake mix, and powdered milk, and beans and rice for a year. Ever since then, my parents have kept a food storage, and they keep it updated and fresh. Those close to me, my friends and extended family, were not nearly as fortunate.“ – ssauronn

Citigroup’s fraud led to many deaths of despair:

US life expectancy was rising almost every year for decades straight. However, it peaked in 2014, and has been in a multi-year sideways trend for the first time in decades. This recent flat-lining in life expectancy has been a uniquely US phenomenon. Life expectancy continues to increase in virtually every other highly-developed country/continent. Life expectancy went up from 2014-present in Japan, the Euro Area, Canada, Australia, etc.

Income & wealth inequality – particularly if it is driven from the combination of the offshoring of the industrial base Clinton & Bush did then the sort of fraud Citigroup did – often leads to a breakdown of cooperation across society, and then, arbitrary violence.

If you make people’s lives miserable and tell them they are victims many of them will believe you.

Some of them will live down to the standards you set and see any isolated incident as a pattern of conduct which deserves retribution.

The media tells people economics is violence, words are violence, they are victims, they are owed something, and … surprise … that drives violence.

Violence is a (temporary) shortcut to status for young men with lots of testosterone but limited prospects or success in society.

Growing up in a single parent home on welfare only adds further fuel to that fire because there is not only a sense of entitlement and unfairness, but often elevated stress levels and a deep sense of shame and resentment.

My Daughter Was Nearly Killed by Racism

I now have a 4 year old daughter. I have screwed up a great many things in life, but I don’t know anybody more confident than she is.

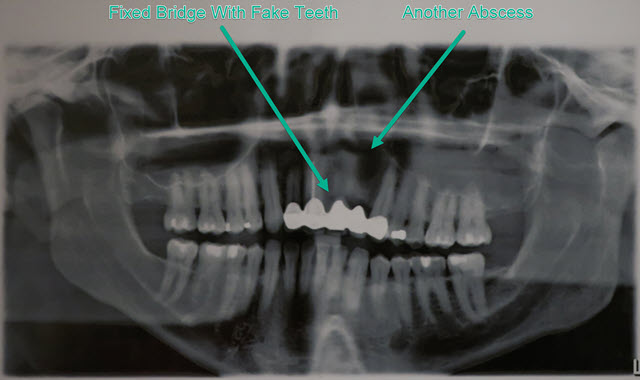

When my wife was pregnant with our only kid I nearly died from a sepsis infection & my daughter was nearly a miscarriage.

The above is not hyperbole.

Here I was in the hospital getting multiple IV antibiotics.

When they told me I might die soon I was like „oh well, that’s that.“

Then my wife came over and heard that & was crying uncontrollably. I then realized the sort of cascading set of dire outcomes and played it off like the infection was nothing while pushing to do whatever I could to get better fast before other bad outcomes happened.

A couple months later our dog died and my wife then gave an emergency early birth. His death caused an early term birth. If I had died a few months earlier then almost certainly my daughter would have been a miscarriage, then my wife likely would have committed suicide.

About a decade prior – around the time Obama was making Citigroup whole on their frauds while passing the costs onto the rest of society – a racist black guy sucker punched me while calling me nigger. That chipped the root of one of my teeth. Slowly over the next decade part of my jaw rotted away from an infection that exploded into near death in the middle of my wife’s pregnancy. And my daughter nearly had no life.

Writing the above will have many people suggest it is I that am racist for suggesting the racist person who tried to kill me should have had a longer prison sentence for his other previous violent crime convictions, or maybe we should restructure the economy away from financial bubbles, monopolies, and offshoring.

I’m of the view that anyone who is convicted of multiple separate violent crimes should be permanently caged or put to sleep, because when you commit violent acts repeatedly you do not deserve to live as you are not only harming the person you sucker punch or such, but you could also end the life of their unborn child.

The sepsis happened while we were traveling. The initial hotel we were staying at was sold out on the final day so I just happened to stay in a hotel across the street from a hospital. A few hours before jumping on a 15 hour flight I went over to the hospital and they turned me away saying it was just a dental issue. Then my wife brought be back over, they looked at me, and were like … oh, you are about to die.

That infection came back no less than 3 times. I had to get multiple teeth ripped out. I’ve had multiple fixed bridges.

If you add up the health expenses, emotional issues (more for my wife than me – much harder to lose someone you love than it is to die), inability to work, having teeth being wired in place, what seems to be dozens of dental visits, getting teeth ripped out repeatedly, etc … my social „safety“ net payment funding kids being born into broken homes with no dad not only nearly liquidated my family, but also cost millions extra.

I absolutely despise race baiters who promote arbitrary violence and the big crimebanks like Citigroup which plunder society leaving people hopeless.

Fuck those people with a rusty chainsaw.

Likewise the Marxist scum that founded Black Lives Matters and is buying about a house a year while promoting people like me being sucker punched by racist low-IQ pay-to-breed garbage or enslaved to pay for the „Marxist’s“ 3rd, 4th, or 5th estate.

I live on the other side of the world and thus do not get to vote on how 30%, 40%, or (if Biden uncaps FICA) 50%+ of my labor is spent.

Why do we need to remove the FICA cap?

So we can pay fraud-based prices for medicines used by others.

Insulin back up to $1,500 for a 90 day supply. Thank President Biden. Big Pharma’s investment paying off. Meanwhile, minimum wage increases looking iffy, trade protections disappearing, low-wage immigration influx incoming, energy jobs cut, and stimulus checks shrinking.— Robert Barnes (@barnes_law) February 11, 2021

Last year when I ACHed income tax payments I sent in over 1,000 times what the president did.

One of my friends told me they didn’t blame Trump they blamed the system, but I thought that was an absurd claim as a leader should not only comply with and improve rules, but they should also set an example.

The idea I should pay a thousand times more while having no vote or voice *AFTER* leaving on account of being nearly killed by a racist person who called me nigger, WHILE also being lectured about racism … is a bit much.

The reasons I liked Trump (before the $750 income tax payments and nutbag January 6th fiasco) were:

- he was hated by the media, so they’d cover wrongdoings (even making some up)

- until the COVID-19 crisis hit, he was broadening the economy (which is why he got higher minority votes than any republican presidential candidate in decades in spite of the COVID-19 lockdowns)

- his administration pushed through an antitrust lawsuit against Google for their monopolistic bundling practices (which will at least restrain Google slightly, provided Biden is not a third Obama term)

The above being said, the January 6th fiasco was absolutely idiotic, and looked like it was something out of South Park.

Obama’s Third Term

Google’s Eric Schmidt played a vital role in the Obama elections & administration. Their relationship was so close it was called „The Android Administration.“

When the FTC investigated Google the Obama administration intervened to prevent justice. To pay back Eric Schmidt for his help on the presidential campaigns Obama’s interventions undermined market competition for a decade:

Federal investigators were convinced: Google’s push to take over mobile internet searches was illegal. They had the evidence and urged their bosses to sue. But those politically appointed bosses overruled them. Nearly a decade later, the Justice Department and state regulators are suing Google over the same multibillion-dollar smartphone contracts that investigators for the Federal Trade Commission flagged years ago — and arguing that the deals present some of the strongest evidence that Google has built a monopoly.

The FTC had all the evidence they needed to prosecute along with absolute proof of intent to monopolize the market through illegal tying & bundling.

„Rubin also touted internally Google’s plan to corner the mobile phone market… In a 2009 email to then-CEO Eric Schmidt, Rubin said a pending contract with Verizon to drop Microsoft’s Bing search engine and sign on with Google would let the company “own the U.S. market.”‘

jfc— Matt Stoller (@matthewstoller) March 16, 2021

The FTC lawyers recommended suing.

But then the Obama administration full of future tech monopoly lobbyists stepped in and disappeared the case without action. They ignored the attorneys and used the staff economist claims rather than the work of the attorneys to justify disappearing the case based on limited search marketshare for mobile at the time.

and don’t miss the must-read, where-are-they-now section https://t.co/r3T3G7zr7n

One of these things is not like the other… #KanterForAAG pic.twitter.com/TIIAquBBq9— Luther Lowe (@lutherlowe) March 16, 2021

About a decade ago Andy Rubin described Google’s payments then to mobile carriers as „humungous.“ Those have only grown larger with time. What was once a small mobile search market is now the majority of search volume. Google now pays Apple at least $12 billion per year to retain default search placement across Apple devices.

Now Schmidt’s shadowy „use AI everywhere in weaponry“ startup is deeply embedded in the Biden administration. A Google lawyer is being considered for the top justice department inside the Biden administration, which would ensure ongoing INjustice is served.

We are back to an administration loved by the media. The controversy are hence reduced to casual magazine cover shoots.

Mainstream media: please serve your vital roll in society. Cover that casual photoshoot and not the Darth Vader aspects of Eric Schmidt, expansions of kill lists for suspects, etc.

The mainstream media & tech companies are so proud of election interference they literally brag about it. The following quote sounds like something out of Fox News or the New York Post, but it was published by Time:

the participants want the secret history of the 2020 election told, even though it sounds like a paranoid fever dream–a well-funded cabal of powerful people, ranging across industries and ideologies, working together behind the scenes to influence perceptions, change rules and laws, steer media coverage and control the flow of information. They were not rigging the election; they were fortifying it.

A half-year of violent demonstrations. Unelected private actors changing election laws & interpretations of election laws & illegally bundling private funds to change the outcome of an election. There were even Facebook pages dedicated to paying people to vote. And hundreds of thousands of people nationwide on standby to hold demonstrations just in case the vote does not go as they planned. It’s a reach to call that democracy.

There still is some actual journalism being done though. I am glad to see articles like this one, which shows just how absurd this page joebiden.com/opioidcrisis/ is.

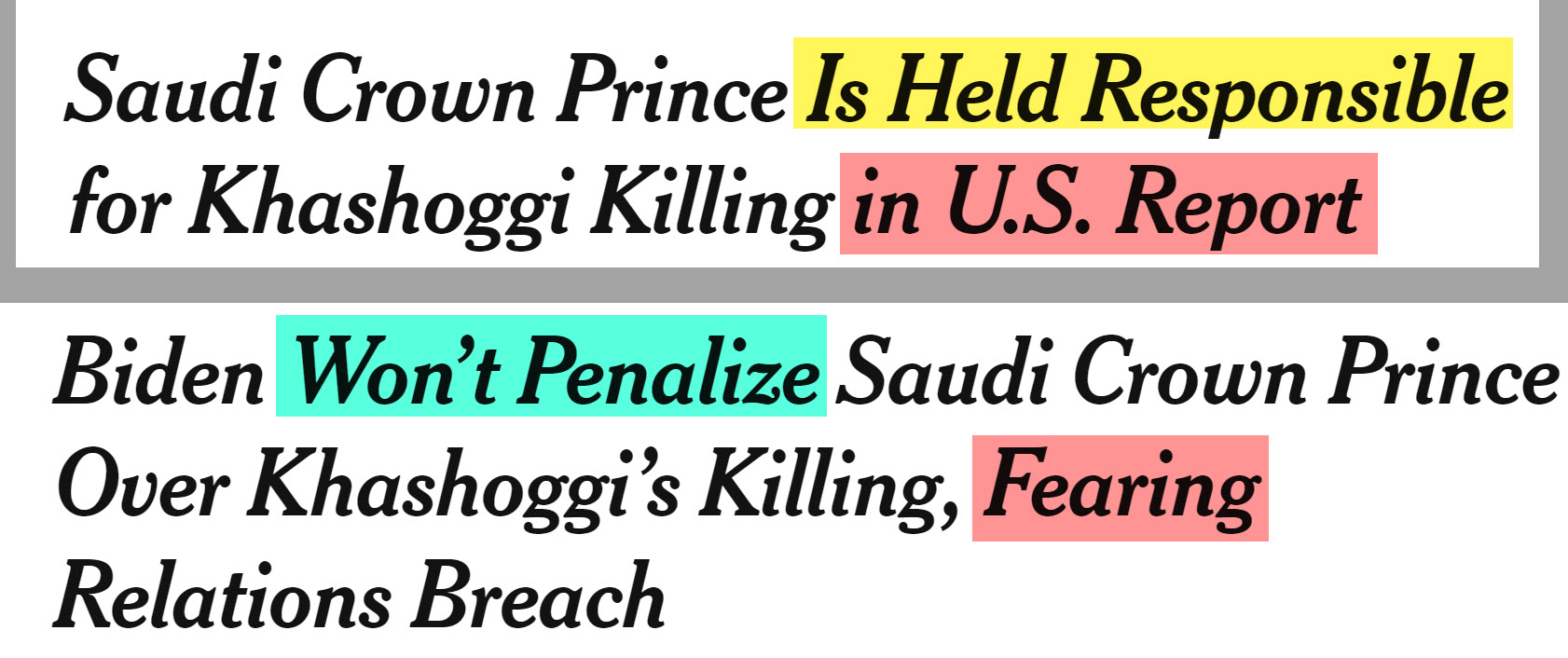

How many media outlets are telling you that we should nuke the Keystone pipeline for the environment, but then get the oil from half-way around the world from a murderous thug autocrat, who we give a free pass to for LITERAL MURDER because he has oil?

the White House is concealing the names of the seventy-six Saudi operatives to whom they are applying visa bans for participating in Khashoggi’s assassination, absurdly citing “privacy” concerns — as though those who savagely murder and dismember a journalist are entitled to have their identities hidden. … The U.S. has instituted policies of torture, kidnapping, mass warrantless surveillance, and due-process-free floating prisons in the middle of the ocean where people remain in a cage for almost 20 years despite having never been charged with a crime. The Biden Justice Department is currently trying to imprison Julian Assange for life for the crime of publishing documents that revealed grave crimes by the U.S. government and its allies, and is attempting to do the same to Edward Snowden. One need not look toward the barbarism of U.S. allies to see what propagandistic dreck is the claim that the U.S. stands steadfastly opposed to authoritarianism in the world: just look at the U.S. Government itself.

A lot of the instability in society is not some accidental biproduct of something else, but is rather intentional government policy.

When rule of law only applies to some of the people some of the time instability can be arbitraged in both directions by those with access to capital and political power. Each additional slice of instability is another opportunity to go long or short some sector of the market.

What do you think has happened to the price of oil recently?

Up, up, up.

The same New York Times which published the above Biden headlines, gave Trump the following coverage:

“In Extraordinary Statement, Trump Stands With Saudis Despite Khashoggi Killing.” was the Times headline, in a piece that said Trump’s decision was “a stark distillation of the Trump worldview: remorselessly transactional, heedless of the facts, determined to put America’s interests first, and founded on a theory of moral equivalence.” The paper noted, “Even Mr. Trump’s staunchest allies on Capitol Hill expressed revulsion.”

What is important is WHO, not WHAT.

Literal murder doesn’t actually matter, unless it can be used to aid in the character smear of someone you dislike.

WHO not WHAT.

„Free“ Trade & Deindustrialization

Biden pushed against the „racist“ attribution of the COVID-19 crisis to its source in China, though few have considered how „free trade“ with a country with over a million slaves would impact living standards as it deindustrializes the country and destroys the middle class.

If a country has a live organ harvesting program for its own citizens, do we want to have close ties to it?

If a state-controlled economy dumps fentanyl into your country and repeatedly hacks thousands of companies for economic espionage & theft of trade secrets they deserve nothing but ire and disrespect, at least until those problems go away.

„Normalizing“ relationships with such a country is idiotic. The only way to normalize those relationships is to undermine & crash their political & economic structure – reciprocate what they have done to you. Put the screws to them as they try to do to you, rather than letting them set up parallel systems to undermine you and sew internal division. Brutish authoritarians only understand force.

While we are seeking out a just global society, does LeBron James say „technically the Chinese Uighur slaves who make my Nike shoes are not black, so it is all good! #BLM“

A decade ago, no one would’ve put NBA superstar LeBron James and Apple CEO Tim Cook in the same family album, but here they are now, linked by their fantastic wealth owing to cheap Chinese manufacturing (Nike sneakers, iPhones, etc.) and a growing Chinese consumer market. The NBA’s $1.5 billion contract with digital service provider Tencent made the Chinese firm the league’s biggest partner outside America. In gratitude, these two-way ambassadors shared the wisdom of the Chinese Communist Party with their ignorant countrymen. After an an NBA executive tweeted in defense of Hong Kong dissidents, social justice activist King LeBron told Americans to watch their tongues. “Even though yes, we do have freedom of speech,” said James, “it can be a lot of negative that comes with it.” – Tablet

Free capital flows plus structural trade deficits from „free trade“ with slave states = declining domestic living standards.

If you want lives to matter & have good outcomes you need to address the core issues. You want strong families, a growing middle class, and to lift trade partner countries up rather than having much of your citizenry see their living standards reduced to being near that of your worst trade partners.

If you have an average to below average IQ, did not come from wealth, have high living costs, and you must compete against literal slaves your life is probably going to suck.

Declining living standards can be masked temporarily through manipulating economic data, but fake data can’t restore hopes and dreams and aspiration for something better.

When I was inside the Fed, it was acknowledged internally that the core PCE was a broken metric that understated & misrepresented true inflation. The decision was made to continue using the broken gauge because Fed models would not work if true inflation was used.

QE is a lie. https://t.co/E3LlQhTPyv— Danielle DiMartino Booth (@DiMartinoBooth) January 4, 2021

That loss of hope will fuel deaths of despair, desperation, and a desire to believe in just about anything.

The race baiting „equality of outcomes“ promoters only throw further fuel on the fire by telling people they are victims and pointing their ire in the wrong direction.

Burning down the local nail salon in a riot is not going to change the Federal Reserve bailing out hedge funds who are manipulating the stock market. It will not make the local economy more vibrant. It will not bring jobs back. It will not fix the free trade with slave state issue.

Instead of acting like an enraged victim, read Kurt Vonnegut’s Harrison Bergeron and then consider what skills you can lean into to make a positive change in the world.

The process and outcome of that „free trade“ with slave states & papering it over with increasing debt leverage was well known in advance: deindustrialization, consolidation, economic bubbles, lower living standards, more corrupt politics, mass migration waves, etc.

Look no further than this 1994 Charlie Rose video interview of Sir James Goldsmith.

Ultra-wealthy plutocrats were willing to partner with the CCP and sacrifice the US middle class in order to gain more wealth and political power.

Why did they trade with an authoritarian regime and send millions of American manufacturing jobs off to China thereby impoverish working Americans? Because it made them rich. They salved their consciences by telling themselves they had no choice but to deal with China: It was big, productive, and efficient and its rise was inevitable. And besides, the American workers hurt by the deal deserved to be punished—who could defend a class of reactionary and racist ideological naysayers standing in the way of what was best for progress?

But if Donald Trump saw decoupling the United States from China as a way to dismantle the oligarchy that hated him and sent American jobs abroad, he couldn’t follow through on the vision. After correctly identifying the sources of corruption in our elite, the reasons for the impoverishment of the middle classes, and the threats foreign and domestic to our peace, he failed to staff and prepare to win the war he asked Americans to elect him to fight.

And because it was true that China was the source of the China Class‘ power, the novel coronavirus coming out of Wuhan became the platform for its coup de grace. So Americans became prey to an anti-democratic elite that used the coronavirus to demoralize them; lay waste to small businesses; leave them vulnerable to rioters who are free to steal, burn, and kill; keep their children from school and the dying from the last embrace of their loved ones; and desecrate American history, culture, and society; and defame the country as systemically racist in order to furnish the predicate for why ordinary Americans in fact deserved the hell that the elite’s private and public sector proxies had already prepared for them.

Alternatively put: „There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning.“ ― Warren Buffett

The terms liberal and conservative are irrelevant in American economic policy, a holdover from the pre FIRE Economy era. The interests of the finance, insurance, and real estate industries will always take precedence in every policy decision.— Eric Janszen (@ejanszen) November 30, 2020

Become an Insider, or Get Used to Losing

For some people the web was a life raft, but a lot of the easy wins have already been had.

And the central network operators are getting more aggressive with scratch-your-back censorship for those in political power.

Sometimes it can be helpful to view the losses as personally targeted if that creates a fire that drives you to do something great

The WSB/GME business is a perfect distillation of populism: people with a vague but correct sense they get a raw deal but who respond with self-destructive nihilism aimed at purely symbolic targets because they are too ignorant and vain to prefer reality to self-righteous fantasy— Dirty Texas Hedge (@HedgeDirty) January 31, 2021

but that fuel burns fast…then what?

fantasy = There’s a conspiracy against me

reality = I get shitty, substandard service because I’m a nobody and no one gives a shit about me— Dirty Texas Hedge (@HedgeDirty) January 31, 2021

The only solution to the good ole boys club is to get big enough that you are no longer an outsider.

If @The_DTCC did do this, and it’s at least plausible to me that they did, then it really is the establishment shutting down this squeeze by using the plumbing to achieve an outcome they regard as desirable.

That’s not the policy goal of regulated clearing and is problematic.— Silent Cal (@KralcTrebor) January 29, 2021

The hot shiny object has a lot of headlines, a lot of competition, and a lot of manipulation.

It is better to do something which is getting less attention but has more staying power.

As more and more services happen online, more and more of business profit margins are flowing online, and the online networks are having a massive impact on the portions of the economy which remain offline.

The central network operators can choose to ban an outgoing president while ignoring politicians who call for genocide in other markets to curry favor to political leaders.

As Zuck would say …

„You can be unethical and still be legal that’s the way I live my life“

A central problem with the web is network effects and the winner-take-all structure of many markets. It creates a few gigantic winners, but many players along the remaining parts of the value chain get squeezed. You could say that getting hit hard by a Panda or Penguin algorithm update and having a business die overnight is a better outcome than the constant slow squeeze where things get just a little bit worse each month.

Monopolies lower wages. limit opportunities and retard innovation. Most the profits go to key players and shareholders while many jobs get shifted into semi-formal rolls.

You can work for Google and they promise that when you put in your letter at your other job to be one of their temp workers they won’t change their mind and fire thousands overnight.

You can work in an Amazon warehouse until you physically break down and they might be so kind as to park an ambulance outside for you instead of wasting profit margin on air conditioning.

Even many of the creative works which are ultimately shunned by companies accustomed to risk-free monopoly profit margins will get squeezed as the work from home / remote work movement will create the next wave of offshoring jobs which people thought you couldn’t really outsource.

If you live in a high cost area you had better do something you love so it is highly differentiated.

The only hope for players along the rest of the value chain is a shift away from the ad-dominated web to one where people pay for the services they like and the distribution outcome moves away from a star-based system to more of a bell curve.

The good news is many websites are removing friction and making it easier to test paid media options. Twitter recently acquired and integrated a paid newsletter service. But at the end of the day most people will eventually need to shift away from app stores and other controlled platforms so they can better differentiate their offering and have a sustainable business as platforms shift business models and what they prioritize to keep up with new trends.

The Attention Merchants dominating the web do not want to be low margin payment processors though, so they aren’t going to make it easy to build a different web architecture where they become less influential.

Governments the world over are working with the large attention merchants & journalists to promote censorship & distort reality.

Google being based out of Bermuda for many years and growing like a weed during the recent recession while the offline economy cratered will lead to some new complicated global taxes which Janet Yellen has already gave a nod to. Politicians like Senator Elizabeth Warren are suggesting new wealth taxes and a 40% exit tax. If those get approved then the bars on where they kick in will fall after they are in place while the ultra rich find new ways to circumvent the law’s intent (e.g. buy hard-to-value illiquid assets or create a self-managed charity that buys up tons of land & then change its status after that law goes away or some loophole is found in it).

Then there is the whole „Great Reset“ where if lockdowns didn’t kill off your business perhaps some other new regulations will (e.g. maybe carbon taxes to you to subsidize your competitor built off a coal power plant in China).

Tim Berners-Lee will likely end up saving the web he created by promoting decentralization.

If that doesn’t work, we are stuck with Zuck and Eric Schmidt & their partners restructuring society as they see fit.

That would would be increasingly unjust, corrupt and violent.

So I am *REALLY* rooting for Tim Berners-Lee to pull a second rabbit out of a hat.

Source:: seobook.com